Business Exit Plan

Business Exit Plan is Important

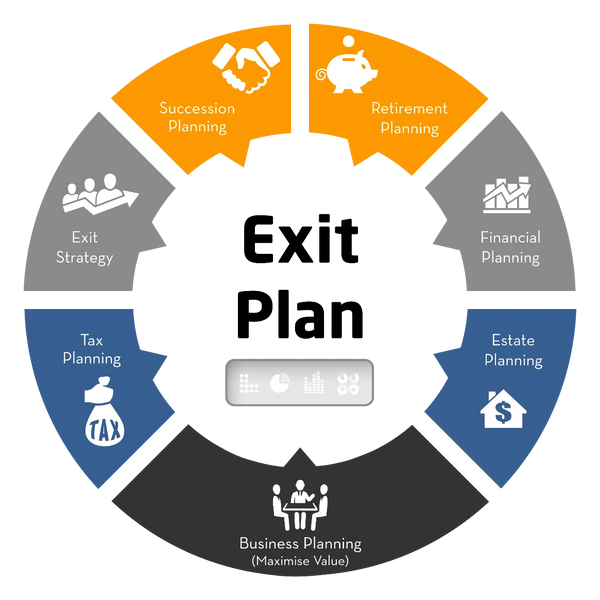

- A business exit strategy is a plan that a founder or owner of a business makes to sell their company or share in a company to other investors or other

- firms.

- Initial public offerings (IPOs), strategic acquisitions, and management buyouts are common exit strategies an owner might pursue.

- If the business is making money, an exit strategy lets the owner cut their stake or completely get out of the business while making a profit.

- If the business is struggling, implementing an exit strategy or "exit plan" can allow the entrepreneur to limit losses.

- It requires specific plans to connect after the Exit of the business.

Modern Qualified Plan Custom Retirement Tax Strategy

What To Know About Pension Plans

Tax-Deductible Contributions

Tax-Deferred Growth

- Contributions made to a Pension Plan are deductible for Federal & State Income Tax purposes.

Tax-Deferred Growth

- Amounts contributed to a Pension Plan Investment

Account grow tax-deferred until distributed from the

plan or a rollover IRA.

Tax-Free Benefits

- Life Insurance Policies funded as a component of a

Pension Plan provide for a Tax-Free Death Benefit

and can provide for Tax-Free Growth & Income

when repositioned out of the plan.

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.